Real Estate Best Long Term Investment

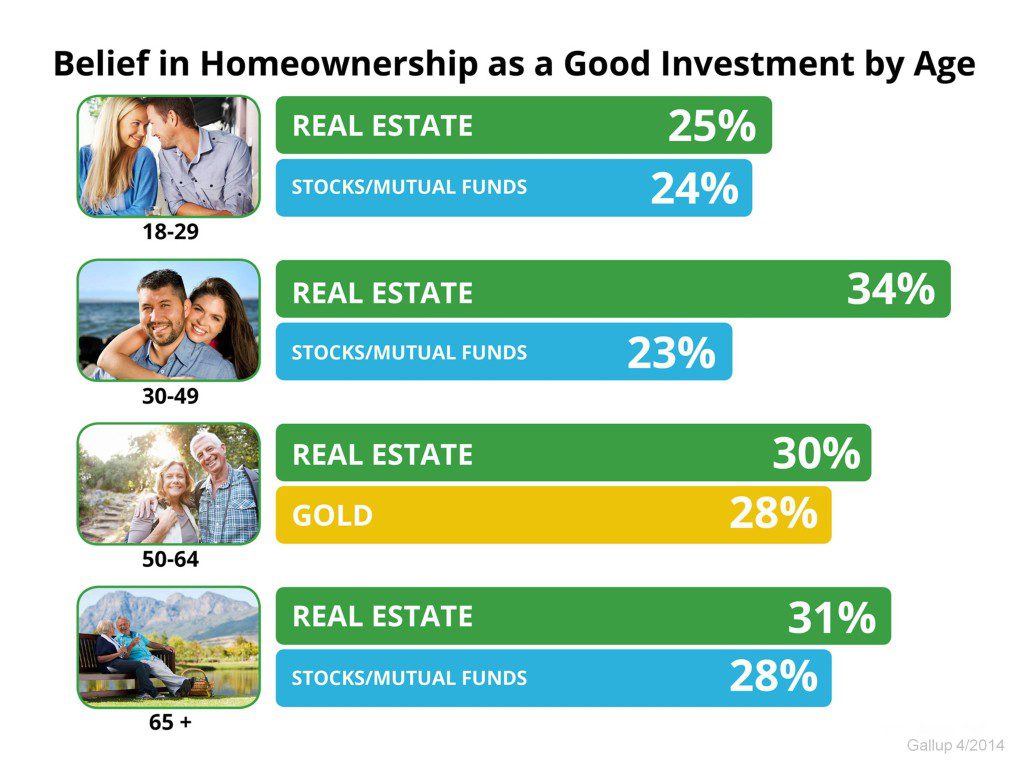

According to a recent study by Gallup, there has never been a time that real estate hasn’t been seen as a better investment. Even though we’ve gone through a rough decade. This brand new Gallup Study shows that if you take a look at all the different types of investment, real estate – according to their poll – still comes out as the best long-term investment available. Better than gold, better than stocks and mutual funds, better than putting your money in the bank, and better than bonds. As you can see in the chart above, in every age group, real estate is the number one pick. In every age group, whether a young 18 to 29-year old or whether they are longer on in their years. Everyone in the country, to matter what the age group is, realizes how great an investment real estate is.

The two major segments, demographics that are going to really impact the real estate market over the next 18 months, the Millennials and the Baby Boomers, both of them think that what we sell is the best long-term investment they can get. And here is something really interesting . . .

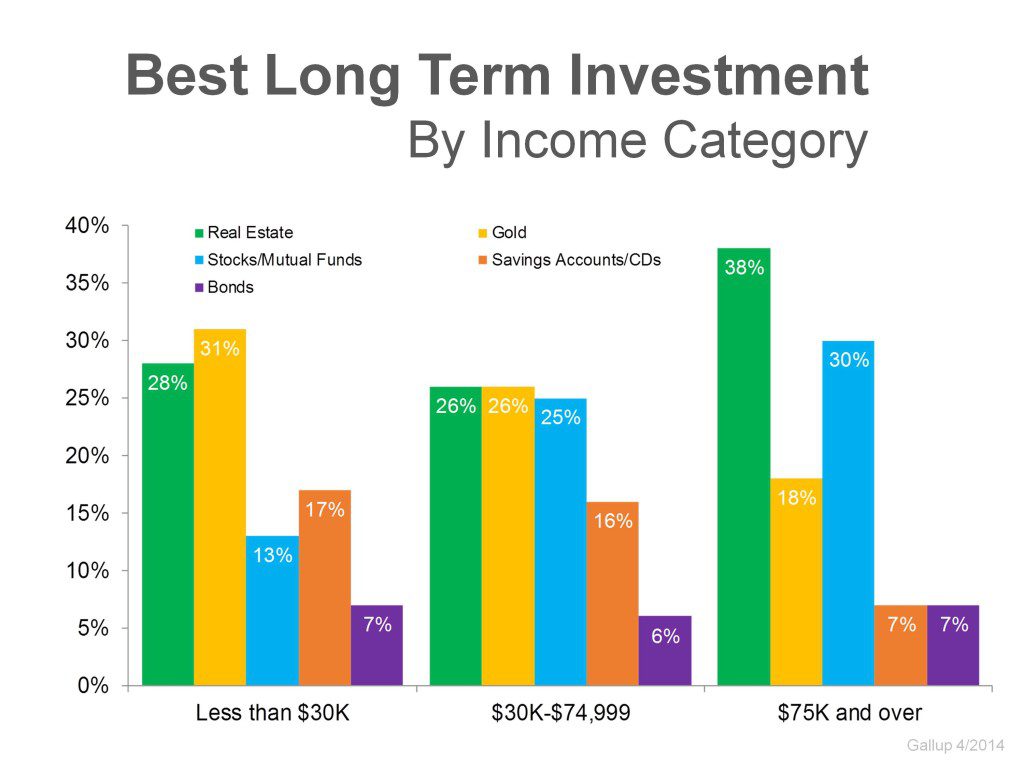

The Gallup Poll broke it down by income – what do people at different incomes think? And the interesting thing is if the person was making less than $30,000, they thought the best long-term investment would be gold. But if they were making $30,000 to $75,000, real estate just as good as gold. And for the people making $75,000 a year or more, they realized that, by far, real estate was the best investment. So the takeaway here is: People of wealth realize what a great long-term investment really is if that goal for their family is to build family wealth, is to be in a better place ten years from now than they are now.

Home Prices Going Forward

Home prices going forward now – When many are saying “Oh, maybe the housing market is not recovering – well wait a second, maybe things are starting to turn to a negative in the housing market is not recovering, bot Morgan Stanley and Barclay’s are leaving their price projections unchanged. Morgan Stanley thinks prices will be up five to seven percent this year. And Barclay’s thinks it’s seven percent. But the single most important thing, they are not changing their projection. The market is find and two of the biggest investment houses in the world are saying, “Things are still going to be going very, very well”

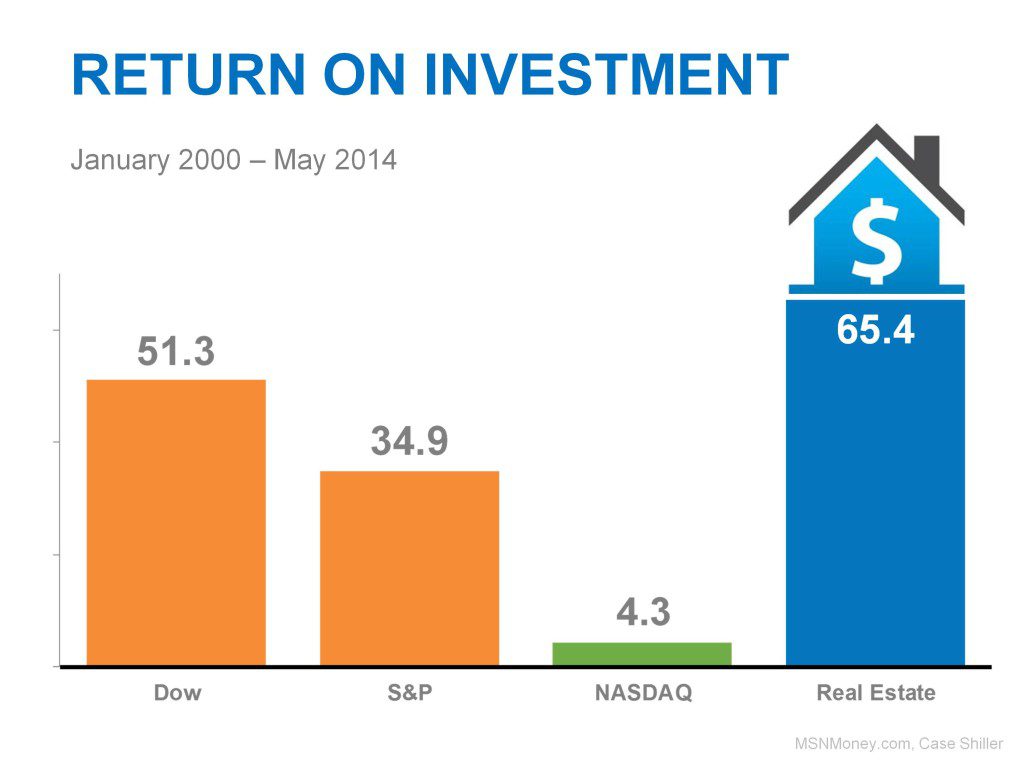

Return on Investment

Now lets talk about return on investment (ROI) – the real estate market against the stock market. The stock market is doing very, very well. Over the last couple of years now it’s been doing very well. But if we go all the way back to January 2000, it still hasn’t caught up to real estate. See the chart below to view the ROI for each stock index versus real estate.

You can see what is going on locally here in the Myrtle Beach Real Estate market. If you are considering adding to your real estate portfolio, you can feel confident in your decision to move forward. If you are interested in the property in the Grand Strand – Myrtle Beach area, we are happy to help you in any way that we can.

You can view the Gallup Study here for more details

[wpdreams_rpp id=1]

Leave a Review/Comment